Include your property number if available. If you own property in Charles County, please notify our office of any address changes. Also, check your escrow analysis statement to verify your taxes have been paid by your mortgage company. If your property taxes are put in escrow by your mortgage company, please forward all bills to them. The first installment is due by September 30 of each tax year, and the second installment (including applicable service charge) is due December 31 of each tax year. Owners of properties designated as "principal residence" are now eligible to pay real property taxes in two semiannual installments. New construction tax bills (for additional taxes after improvements are made to a property) are generally mailed in October (3/4 year), January (1/2 year), and April (1/4 year) of each year.

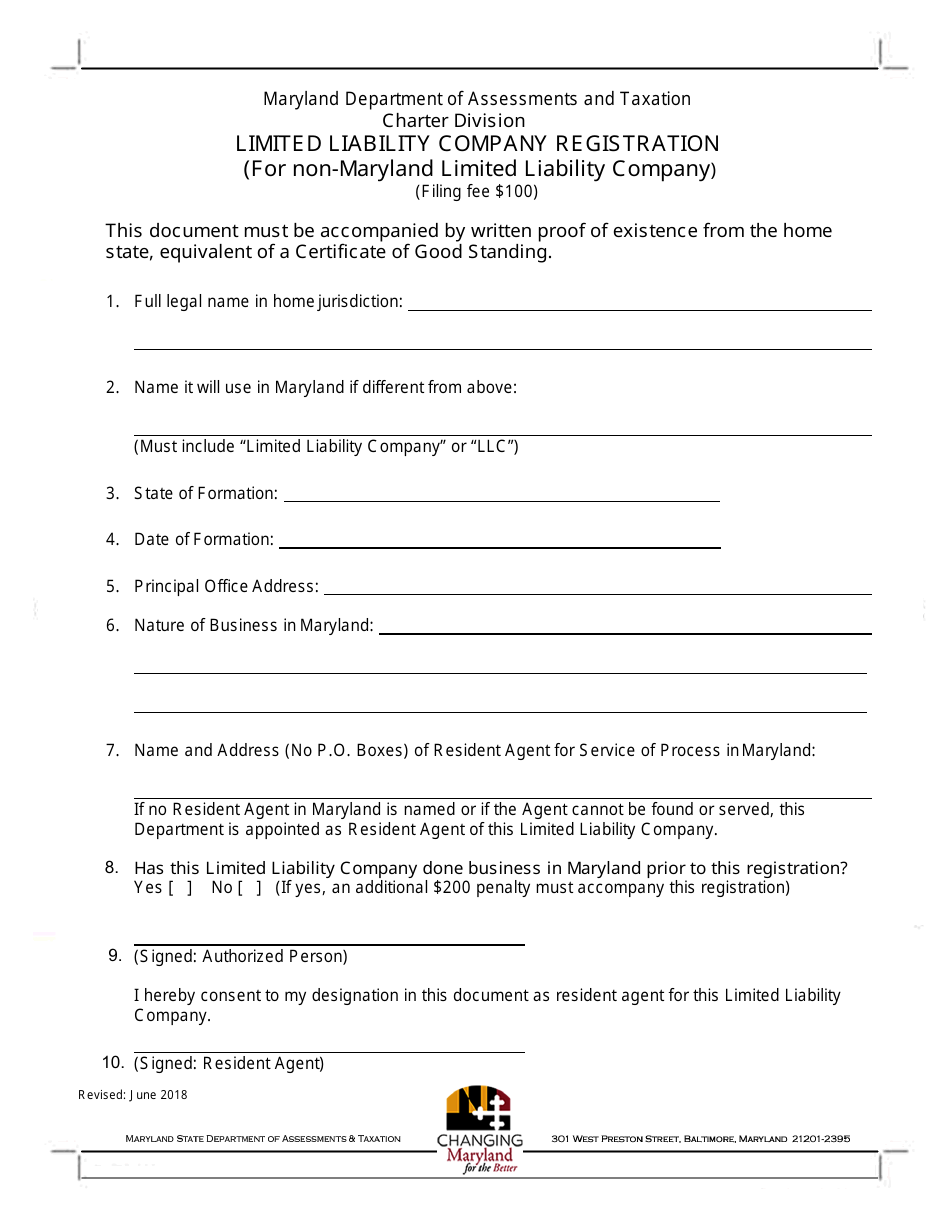

If you do not receive one, please contact our office immediately. This office maintains all tax accounts for real property including billing, processing additions, abatements, transfers, address changes, tax liens, and conducting the tax sale each year.įull year real property bills are mailed July of each year. Charles County Annual Tax Sale (Held each May).State Department of Assessments and Taxation.School Construction Excise Tax Presentation.Approved Property Tax Rate Ordinance Fiscal Year 202 2.

0 kommentar(er)

0 kommentar(er)